You Built It with Heart. I’ll Grow It with Care.

I’m Kyle Nicholson, an independent buyer seeking great businesses in the Ohio Valley and Upper South. I’m committed to honoring your legacy and growing your company for the long term.

The Kyle Nicholson Company is a hands-on firm that acquires established businesses —guiding them to sustainable growth. I’m not in a hurry to buy, ensuring owners never feel rushed. When we align, I bring my brand-building and data-driven expertise to elevate your business—without losing what makes it special. Unlike quick-flip buyers, I honor your legacy and invest in your people.

Business Criteria

Ohio Valley and Upper South (Kentucky, Southern Ohio, Southern Indiana, East Tennessee)

Mature or Growing Business

Consistently Profitable for 4+ Years

EBITDA $500K to $4M

Competitive Differentiation

Excluding (Legal, Food Service, Financial Services)

Owners we serve

Stepping Back: Retire without losing legacy.

Local Legacy: Keep people, culture strong.

Focused Role: Remain in your specialty.

Next Venture: Pass the reins and move on.

You only sell your business once — and who you sell to matters.

This isn’t just about price. It’s about what happens next: to your people, your reputation, and the business you’ve built. Here's how my approach differs.

| Key Factor | Private Equity | Competitors | The Kyle Nicholson Co |

|---|---|---|---|

| Your Legacy | One of many; uncertain | Absorbed; identity fades | Priority; culture endures |

| Buyer’s Goals | Returns, fast exit | Integrate, cut costs | Steady growth, invest in people |

| Deal Terms | Rigid, investor-driven | Parent’s agenda | Flexible, seller-friendly Open to partnership approach or 100% buyout |

| Capital Sources | Institutions with strict returns | Corporate reserves & debt | Local entrepreneurs, long-term partners |

| Time Horizon | 3–5 years; forced sale | Uncertain, parent-driven | Open-ended, your legacy thrives |

I’m Kyle Nicholson. Over the years, I’ve sharpened my leadership skills at Procter & Gamble, where I worked across 10 countries to develop new business models and categories. I then revitalized iconic playing card brands Bee and Bicycle at The United States Playing Card Company, and modernized analytics at Cummins. Now, I’m on the lookout for a stable, profitable enterprise in the $750K–$2M EBITDA range—somewhere I can preserve a legacy while adding fresh energy.

What sets me apart isn’t just my track record of elevating sales or mastering operations; it’s my commitment to trust, honesty, and genuine relationships. I believe that growth happens when people feel heard and valued—whether they’ve been part of the team for decades or are new hires brimming with bold ideas. That’s why, at every stage of my career, I’ve prioritized collaboration, open communication, and long-term loyalty. If you’re considering selling the business you’ve poured your heart into, I want you to know I’ll honor that foundation and build upon it with respect, care, and unwavering integrity.

Outside of my professional pursuits, my wife and I are deeply committed to serving our community through foster care. Together, we have opened our home to four young children over the years, providing stability and support during critical times in their lives. I also extend my impact by serving on the Kentucky Citizen Foster Care Review Board (CFCRB)—a statewide, 800-member volunteer organization that plays a vital role in the child welfare system. In addition to reviewing individual foster care cases and providing formal recommendations to judges, I serve in a leadership capacity on the CFCRB’s executive committee.

About Kyle

Financial Capabilities

Solid relationships with local and national banks

Exceptional Personal Credit and No Debt

Flexible Financing Structures

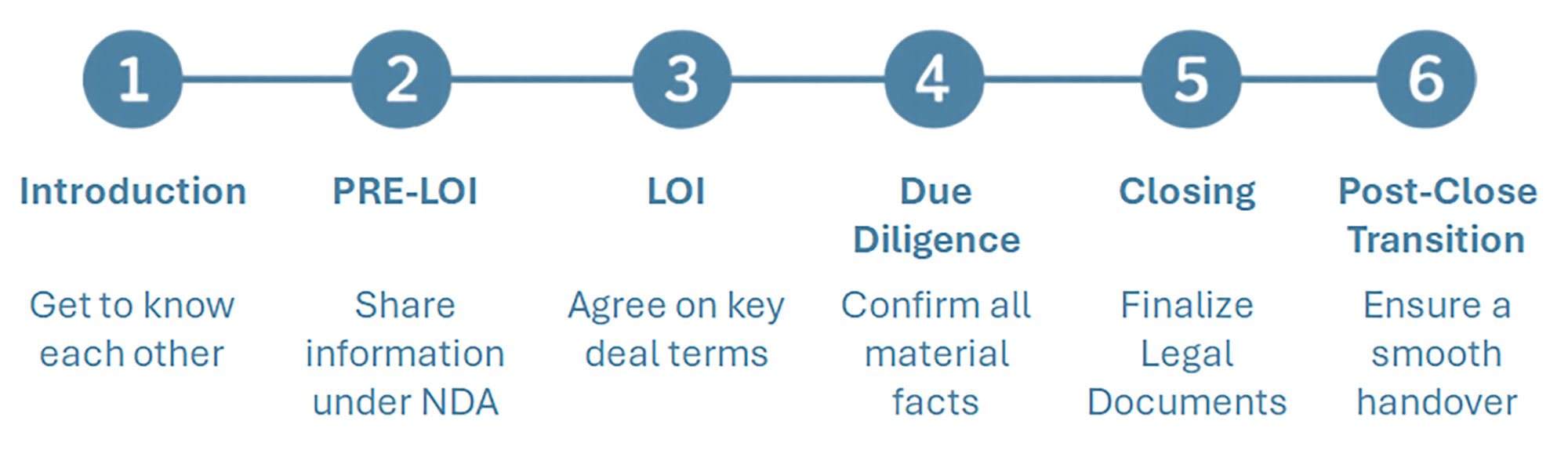

The Process

Selling your business can be both thrilling and unsettling, especially if you’ve never experienced it before. I want to make that process clear, respectful, and aligned with your company’s long-term success. I take a personal, hands-on approach—one that prioritizes preserving your legacy.

If you’re worried about “corporate buyers” who flip businesses after a few years, rest assured that’s not my style. I value steady, sustainable growth, respect for employees, and strong community ties. Below is an overview of the process, from our first conversation all the way through the post-close transition.

1. Introduction

When we first connect—by phone, video chat, or an informal meeting—I want to hear your story. How did you start the business? What keeps you excited about it today? What concerns or goals do you have for the future? There’s no lengthy paperwork at this stage, just an open dialogue to see if we’re a good fit. I’ll share my background too.

I believe a strong personal connection is key. You’ve spent years—maybe decades—building this enterprise, and you deserve a buyer who understands its nuances. If we find mutual alignment here, we’ll move forward to the next stage. If not, that’s perfectly okay: I want you to be confident in whoever takes over your life’s work.

2. Pre-LOI (Before the Letter of Intent)

If we decide to proceed, we enter what I call “Pre-LOI.” LOI stands for Letter of Intent, which will eventually outline the core terms of my offer. But before drafting any official document, I need enough information to make a fair proposal—without burying you in requests.

Confidentiality

I’ll sign a Non-Disclosure Agreement (NDA) to ensure any financials, operations, or customer data you share stays private. This is simply professional courtesy: I respect the trust you place in me by opening your books.Information Gathering

I may ask for summary financial statements (like profit/loss, balance sheets, and tax returns), as well as an overview of your operations. My goal is to form a complete, realistic picture of how your business runs, so I can propose a deal structure that makes sense for both of us.Q&A & Possible Site Visit

We’ll likely continue our conversations—answering each other’s questions, addressing concerns, and maybe scheduling a site visit if you’re comfortable with that. I’m flexible on the timing: if you prefer to maintain confidentiality until we sign an LOI, I’m happy to wait. Clear communication now helps us avoid misunderstandings later.

By the end of Pre-LOI, I should have a good grasp of your company’s fundamentals, and you should feel confident about my approach and integrity. This sets the stage for a genuine, thoughtful offer.

3. LOI (Letter of Intent)

Next, I’ll draft a Letter of Intent (LOI), which outlines key points of the proposed deal. It typically includes:

Purchase Price: The amount I’m offering to buy your business.

Deal Structure: Whether it’s an all-cash offer, if there’s a seller note, or any other financing components.

Timeline: Rough dates for due diligence, legal finalization, and closing.

Exclusivity Period: A window of time where we focus on each other and not engage with other buyers or sellers.

An LOI is mostly non-binding except for the exclusivity clause, but I don’t treat it lightly. If my due diligence confirms what I’ve learned so far, I fully intend to close the deal. I’ll walk you through the LOI in plain language—no hidden jargon or legal tricks. You can have your advisors review it, and I’m happy to adjust as needed if we both stay aligned on the core terms. Essentially, the LOI is our handshake agreement: if we don’t hit any major surprises in due diligence, we’ll proceed to final signatures.

4. Due Diligence

After the LOI is signed, I embark on a due diligence journey to verify key details about your business. Think of it as a deeper dive into the financial, operational, and legal aspects:

Financial Check

I’ll look closely at monthly statements, tax filings, receivables, and payables. My aim is to confirm that the numbers match what we’ve discussed.Operational Assessment

This covers things like supplier relationships, customer contracts, and employee roles. I want to see what makes your business tick on a day-to-day level so I can maintain (and hopefully enhance) its strengths post-acquisition.Legal & Compliance

Reviewing leases, licenses, or potential liabilities is standard. If there’s any pending litigation, we’ll address it upfront.

Yes, due diligence can be time-consuming, but I do my best to minimize disruption to your daily operations. Usually, I’ll provide a structured checklist of what I need, rather than bombarding you with random requests. Communication remains key: if questions pop up, we’ll resolve them together in a collaborative, problem-solving spirit. My intention is not to “catch” you out, but to ensure there are no big surprises lurking that would derail the sale.

5. Closing

Closing is that pivotal moment where ownership officially transfers, and you receive your agreed-upon compensation. Because we’ve already clarified most details in the LOI and due diligence, closing typically feels like the logical final step, not a dramatic negotiation. Attorneys on both sides finalize a Purchase Agreement, reflecting the terms we’ve already agreed upon. Once you sign and the funds are wired, the business is legally mine—and you can breathe a sigh of relief (hopefully a good one).

I care deeply about how your employees and customers learn about the change. We can coordinate announcements, meetings, or letters so there’s no confusion. My style is to reassure everyone that operations continue as usual, with a focus on people, community, and steady growth. If you have ideas about how best to communicate or celebrate the sale, I’m all ears.

6. Post-Close Transition

I don’t see the closing date as “the end.” Rather, it’s the beginning of a new chapter for your business. Depending on your preferences, you may:

Exit Immediately

Some owners are ready to retire or move on right away, and that’s totally fine.Stay for a Transition Period

Others agree to consult or stay on for a few weeks or months to help me learn the ropes. This can be immensely helpful if you have unique processes or special relationships that need a personal handoff.

I’m flexible here. The important thing is ensuring continuity for the team and customers. As a local, long-term owner, I’m committed to retaining the essence of what you’ve built. I won’t swoop in with drastic changes that jeopardize morale or service. Instead, I’ll focus on incremental improvements, informed by a data-driven mindset, to keep the business thriving for years to come.

My Promise

Throughout these six stages—Introduction, Pre-LOI, LOI, Due Diligence, Closing, and Post-Close Transition—my guiding principle is respect: respect for the time, energy, and emotion you’ve invested in your company. I strive to maintain transparent communication, fair dealings, and a genuine appreciation for your team and customers.

Local Commitment: I’m not a distant private equity firm. I live here, invest here, and care about this region’s wellbeing.

Long-Term Stewardship: My aim is to run the business patiently, preserving its culture and reputation. No quick flips or cost-cutting frenzies that damage the core.

Collaboration: I welcome your insight every step of the way. If something’s not clear or you have feedback, let’s talk it out.

Shared Success: You walk away satisfied, with your legacy in safe hands. I take on a thriving operation, ready to support it for the next chapter.

If this aligns with what you envision for your business’s future, I’d love to connect. Selling a company is a big step, but it doesn’t have to be overly complicated or stressful. With the right partner—a partner who values trust, people, and the community—the process can actually feel like a positive transition for everyone involved.

So, if you’re interested in discussing your plans or simply have more questions, reach out anytime. I’m always happy to share more about my background, my approach, or just talk shop about what makes your business unique. Let’s start a conversation and see if we’re the right fit for each other.